Crypto

Basel Committee Proposes Changes to Criteria Giving Stablecoins Preferential Risk Treatment Among Crypto Assets

However, cryptos with “effective stabilization mechanisms” qualify for “preferential Group 1b regulatory treatment.” This means stablecoins can be subject to “capital requirements based on the risk weights of underlying exposures as set out in the existing Basel Framework,” instead of the tougher requirements set for bitcoin and the like. Source link

OFAC Accepts $1.2M Fine from Crypto Exchange CoinList to Settle Allegation of Russia Sanctions Violations

“This enforcement action further emphasizes the importance for virtual currency companies and those involved in emerging technologies to incorporate risk-based sanctions compliance into their business functions, especially when the companies seek to offer financial services to a global customer base,” OFAC said in a media release. Source link

In Search of the Elusive Crypto Voter

On Monday, a New Hampshire state representative asked a mostly-filled room at an industry campaign event to raise their hands if they were visiting from another state. More than half the people in the room raised their hands. These visitors had come to hear from industry representatives, state lawmakers and – perhaps most importantly –…

Starknet, LayerZero, and More Fuel Crypto Rally with Token Releases

Loyal readers of The Protocol will recall our riff in last week’s issue, headlined “Bitcoin Censorship, or Just ‘Spam Filtering?‘” The gist of the story is that some Bitcoin purists are trying to keep the oldest and largest blockchain free from non-financial transactions – such as the text snippets and images that some people are…

The Tether Killer? A True Stablecoin Would Enhance Banking and Crypto

The serious, potentially fatal flaw with a stablecoin like Tether is the potential for a “run on the bank.” Any stablecoin that invests in anything other than U.S. dollars in a bank account cannot assure its holders that they can redeem their stablecoin at any time, all at once, and receive 100% of the face…

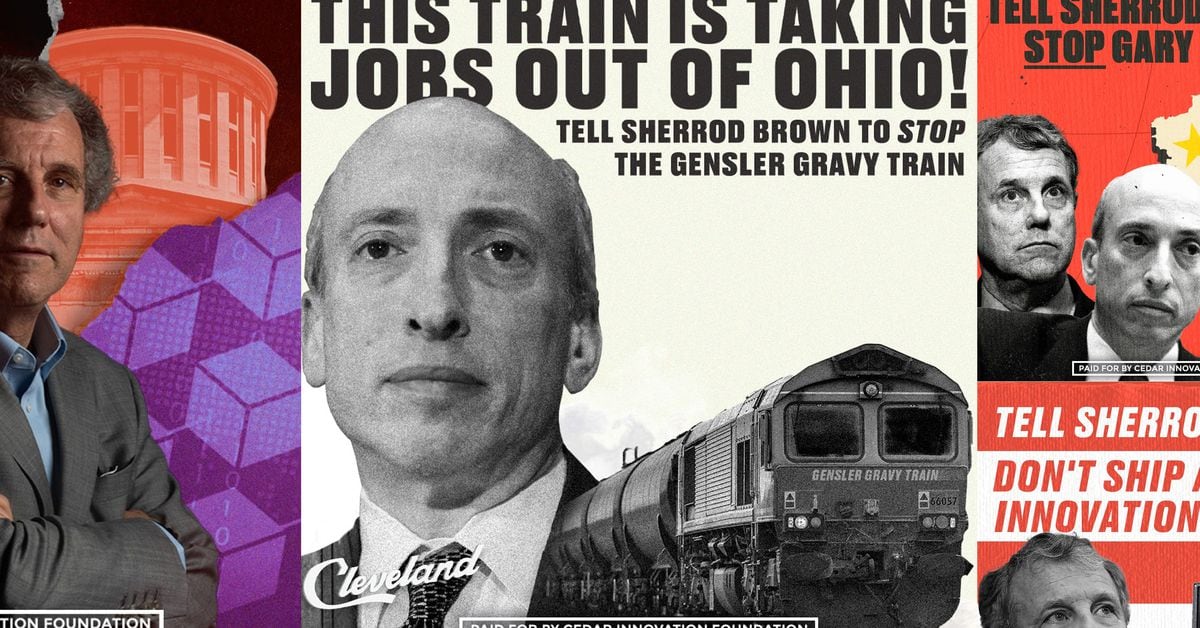

Anonymous Crypto Interests Bombard Key Senator Sherrod Brown With Political Ads

“SEC Chair Gary Gensler is protecting the big banks, stifling American innovation and willing to ship critical American technology and jobs to China,” according to the organization’s website. “Senator Sherrod Brown needs to use his power as Chair of the Senate Banking Committee to stand up to Gensler and fight for Ohio jobs.” Brown, who’s…

FASB Confirms 'Fair Value' Approach for Corporate Crypto Holdings

The Financial Accounting Standards Board, a U.S. entity that details how companies should report assets on their balance sheet, published a standards update on Wednesday that will let corporations recognize “fair value” changes in crypto holdings. Source link

U.S. Presidential Candidates Including Vivek Ramaswamy Chat About Crypto, Target Federal Regulators

Ramaswamy vowed to reduce the agency’s workforce as part of his goal to eliminate 75% of bureaucratic jobs, noting that the third U.S. president, Thomas Jefferson, who died nearly 200 years ago, would be “turning in his grave” over the agency’s actions toward crypto, a technology that was invented roughly 15 years ago. Source link

Bitcoin (BTC) Price Halts at $41K Ahead of FOMC Rate Decision; DOT, ATOM, INJ Lead Crypto Gains

The largest crypto asset recovered to $42,000 earlier in the day from yesterday’s low of $40,200 before dipping to $40,600 in the U.S. afternoon hours. After paring some losses, BTC was changing hands at $41,300, slightly up 0.3% over the past 24 hours. Source link

Warren’s Crypto Bill Is Likely Unconstitutional. It’s Also Unlikely to Pass

This is, in the grand scheme of things, exactly how Warren’s AML operates. Warren’s proposal is written in such a way to increase reporting requirements for nearly every corner of crypto. This includes anything from centralized exchanges, where filing “suspicious activity reports” (SARs) might make sense, and for parts and players in blockchain where the…